sales tax oklahoma tulsa ok

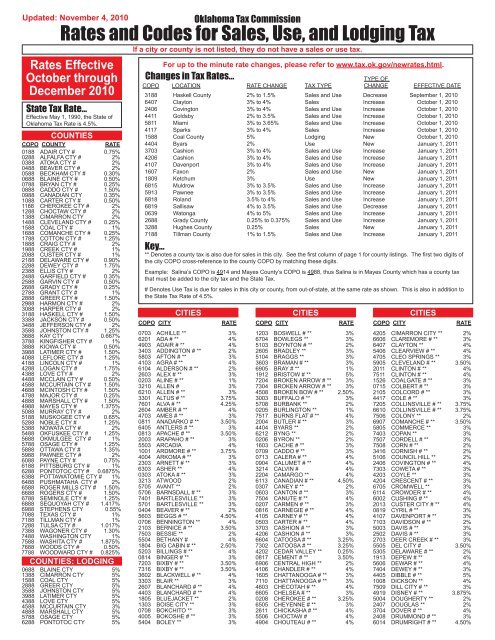

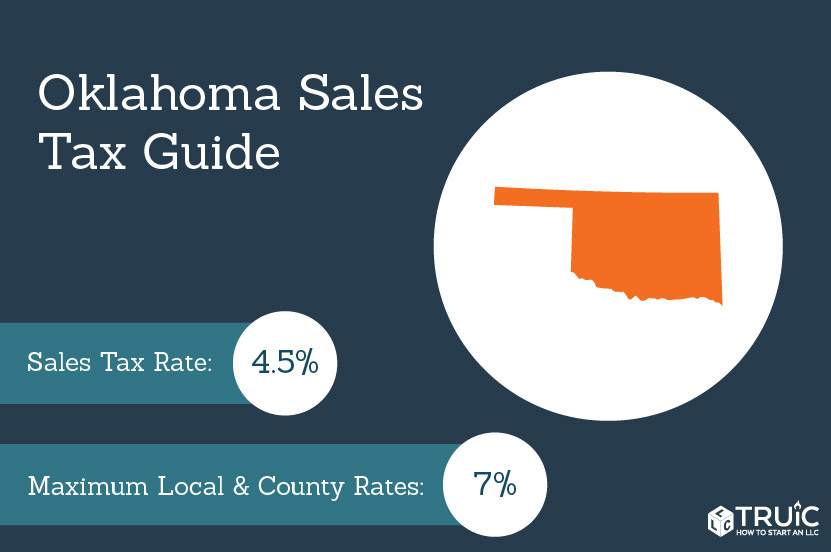

Some local sales taxes are for general purposes and some are dedicated or earmarked for specific purposes such as public safety major capital investments or jails. Oklahoma has 368 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Oklahoma being 45 and the highest Sales Tax rate in Oklahoma at 10.

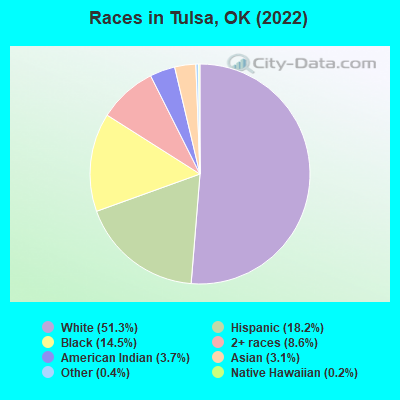

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

When Joe sells this watch he should collect sales tax equal to the state rate 45 the Texas County rate 10 the Guymon city rate 40 95.

. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Real property tax on median home. When Joe sells this watch he should collect sales tax equal to the state rate 45 the Tulsa County rate 1017 the Tulsa city rate 30 8517.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. An example of an item that exempt from Oklahoma is prescription medication. The use tax essentially serves as a sales tax on imports to Oklahoma.

For forms visit wwwoktaxstateokus. The Tulsa sales tax rate is. Merchant Services of Oklahoma.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Tulsa OK Sales Tax Rate. If you want to get your permit more quickly you can apply in person.

Stillwater OK Sales Tax Rate. To review the rules in. Visit the Tax Commissions Online Business Registration System website.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. The County sales tax rate is. Sales Tax in Tulsa.

Tulsa County - 0367. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Fast Easy Tax Solutions.

The December 2020 total local sales tax rate was also 8517. The 2018 United States Supreme Court decision in South Dakota v. Sapulpa OK Sales Tax Rate.

The Oklahoma sales tax rate is currently. The current total local sales tax rate in Tulsa OK is 8517. It is charged when items are bought.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. This is the total of state county and city sales tax rates. 31 rows Norman OK Sales Tax Rate.

Sand Springs OK Sales Tax Rate. For more information and certification contact the Oklahoma Tax Commission at 405521-3133 otcmastertaxokgov. The Tulsa County sales tax rate is.

Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent. State of Oklahoma - 45. Has impacted many state nexus laws and sales tax collection requirements.

Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools Business Sales Tax Business Use Tax Business Forms Withholding Alcohol Tobacco Motor Fuel Miscellaneous Taxes. Sales Tax State Local Sales Tax on Food. 3015 E Skelly Dr Ste 385.

ABOUT OAR Oklahoma Alternative Resources OAR is a 501 c organization that is an advocacy for parents with dependent children who are in need of legal. When you register online expect the agency to take at least five day s to process your application for a sales tax permit. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

The Sales Tax Relief Credit sometimes known as the grocery tax credit is an income tax credit that provides a rebate of 40 per household member to households with. Sales tax at 365 2 to general fund. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa.

Tulsa OK Sales Tax Rate. Youll go to the Tax Commission office in Oklahoma City or Tulsa. Ad Find Out Sales Tax Rates For Free.

Sales Tax Refunds. Shawnee OK Sales Tax Rate. The City has five major tax categories and collectively they provide 52 of the projected revenue.

You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. There is no applicable special. Oklahoma offers sales tax refunds for qualified companies.

The Oklahoma state sales tax rate is currently. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but an individual who owns a store. Owasso OK Sales Tax Rate.

ATM Sales Service. Buyer 2 is located in Guymon OK. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Ponca City OK Sales Tax Rate. Effective May 1 1990 the State of Oklahoma Tax Rate is 45. Oklahoma City OK Sales Tax Rate.

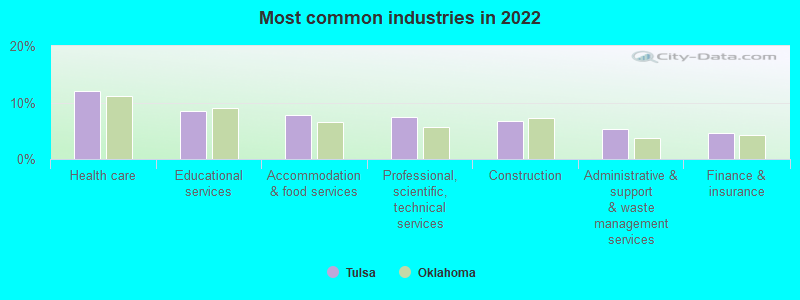

How Does Sales Tax in Tulsa compare to the rest of Oklahoma.

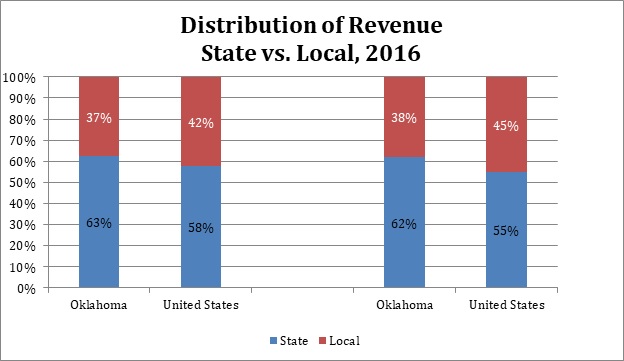

State And Local Tax Distribution Oklahoma Policy Institute

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

Total Sales Tax Per Dollar By City Oklahoma Watch

Taxes Broken Arrow Ok Economic Development

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Total Revenues Of Oklahoma Governments Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute